Linking your bank and credit card accounts to your QuickBooks Online (QBO) account can be a great time saver if done correctly. It also has the advantage of preventing typographical errors. It is like being able to copy and paste all the transactions from your bank statement to your books.

QBO has a protective feature that holds the transactions on the banking page like they are still sitting on your bank statement until you add them to your books. Until you move transactions from bank feeds to your books, they are not in your books. Using this feature intelligently will prevent hours of troubleshooting later. I will refer to this holding area as “bank feeds” throughout this article.

Paying attention to how you add a transaction can prevent a few common problems.

The first common problem is creating duplicates in your books. This can cause overstated expenses or overstated income. Duplicates are usually created when a transaction that should be “matched” is added using any of the three options for adding transactions from bank feeds to your books. It can also be created if a transaction in bank feeds is matched to the incorrect transaction.

The second common problem is assuming that the default QBO chooses for a transaction in the bank feeds is accurate. One client stated, “The bank feeds lie.” This helped her pay attention to what the default was and correct it when needed.

The third common problem is when poorly designed “Rules” are used. Rules, like memorized transactions, would require an entire article to address. However, I will provide the following two cautions:

1. QBO will send a pop-up window to get you to create a rule based on transaction you have added from bank feeds. Do not automatically accept them.

2. Avoid creating rules that automatically add transactions to the books without review.

QuickBooks Desktop also provides a Bank Feeds feature that would inspire some of the same advantages and cautions. The graphics would be very different. If you need help with that, ADKF bookkeepers are always ready to help.

Below is a section with pictures and comments to help you apply a few minutes of prevention against what could turn out to be hours of a troubleshooting. Both duplicate transactions and QBO defaults are covered.

Basics:

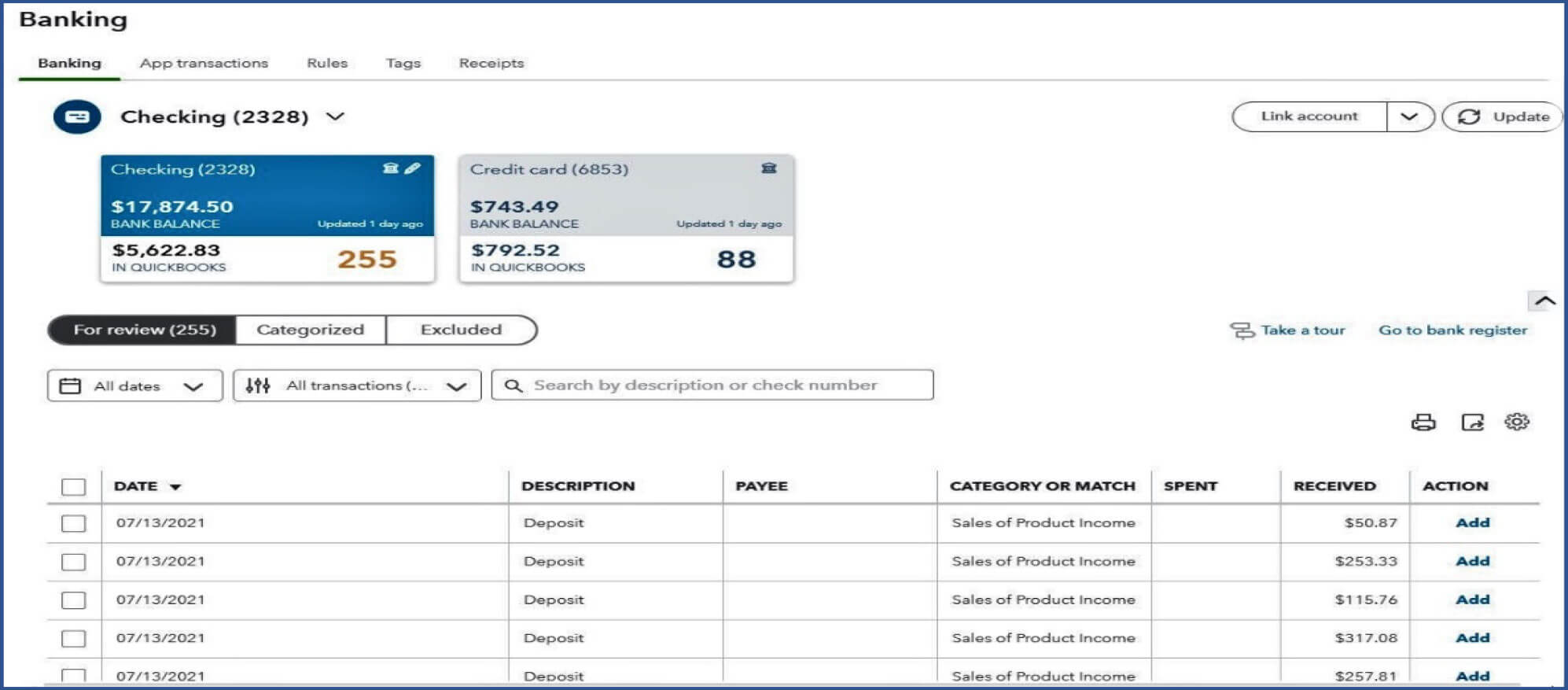

The Bank Feeds Page looks like this:

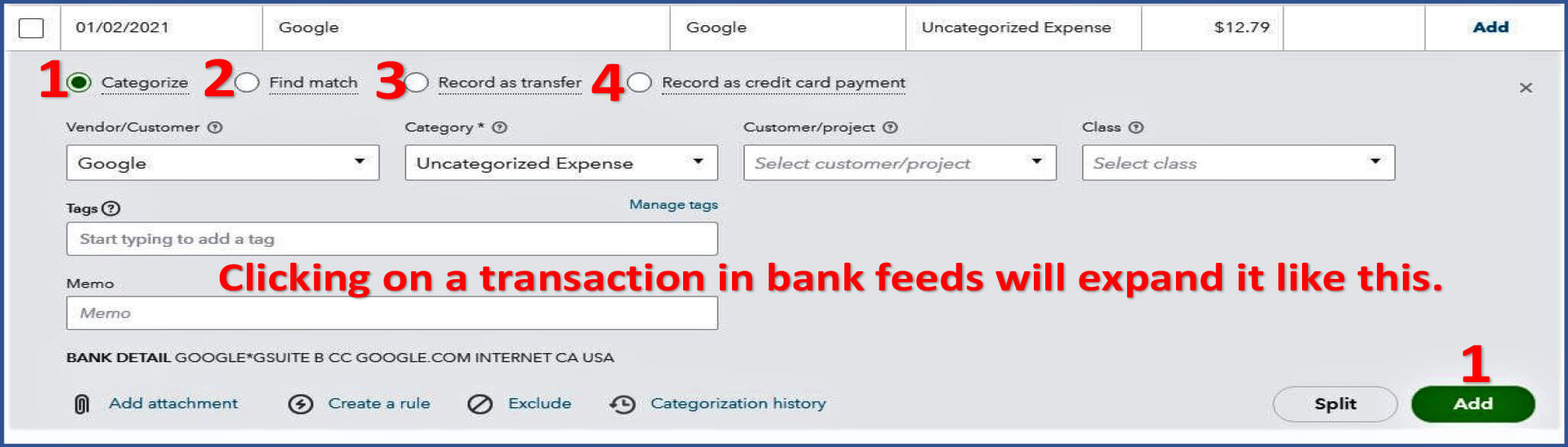

There are four options that can be used for adding transactions to your books from bank feeds:

1. Categorize and ADD.

2. Match to an existing transaction(s).

3. Record as Transfer and ADD.

4. Record as credit card payment and ADD.

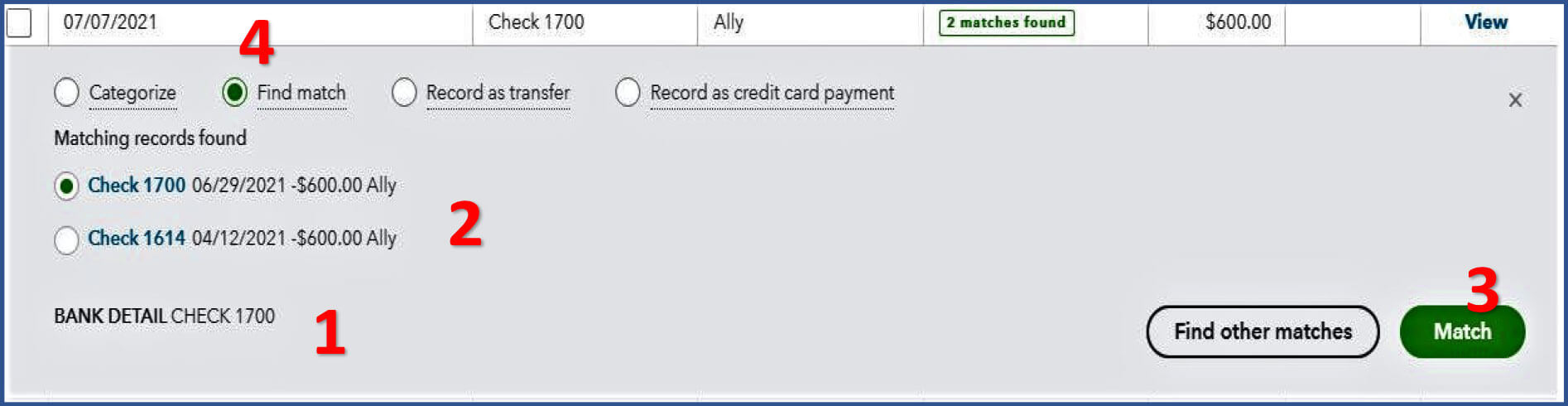

Duplicates caused by incorrect matching:

This is what an expanded transaction looks like in bank feeds with more than one match:

1. Bank Detail gives you the information from your bank statement.

2. Matching records found shows you the transactions already in your books that could match the bank transaction.

Pay close attention to the bank detail and make sure that it matches the transaction selected before you click on the Match button (3). Bank detail can include:

• Check memo: Check number.

• ACH memo: Payee, account # of bank transferred to or from, or account # of credit card being paid.

Also, pay close attention to the date the transaction cleared the bank. (4)

Duplicates created by adding a transaction that should be matched:

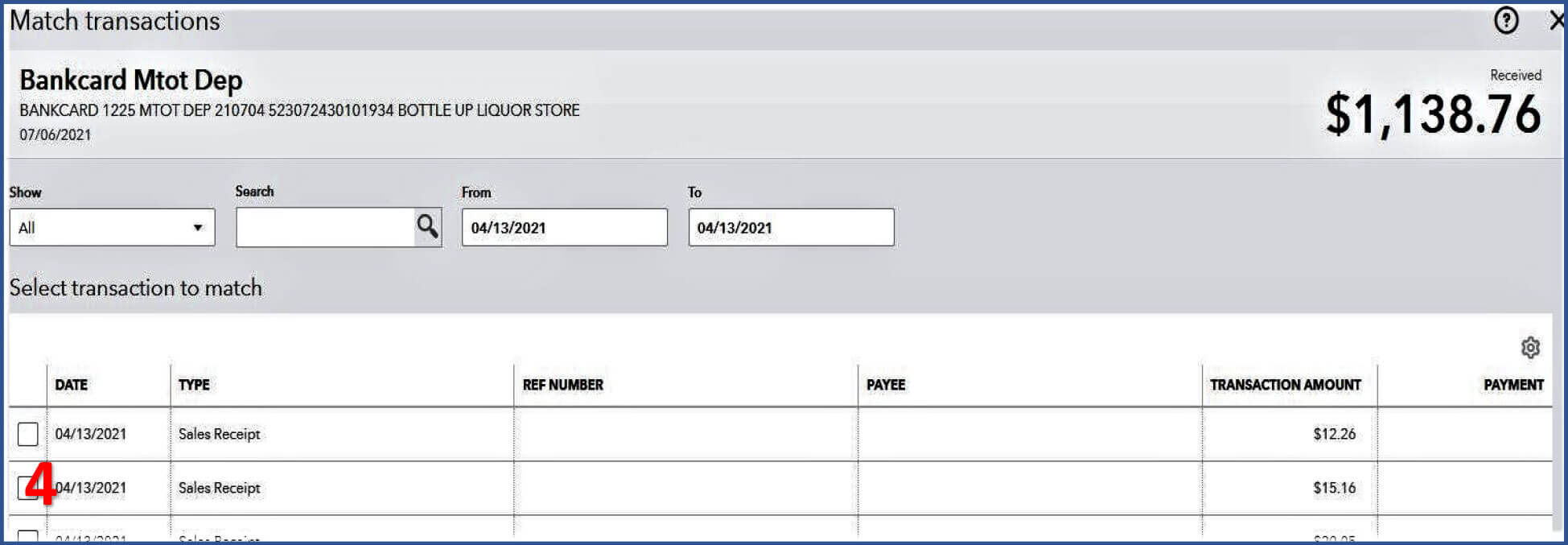

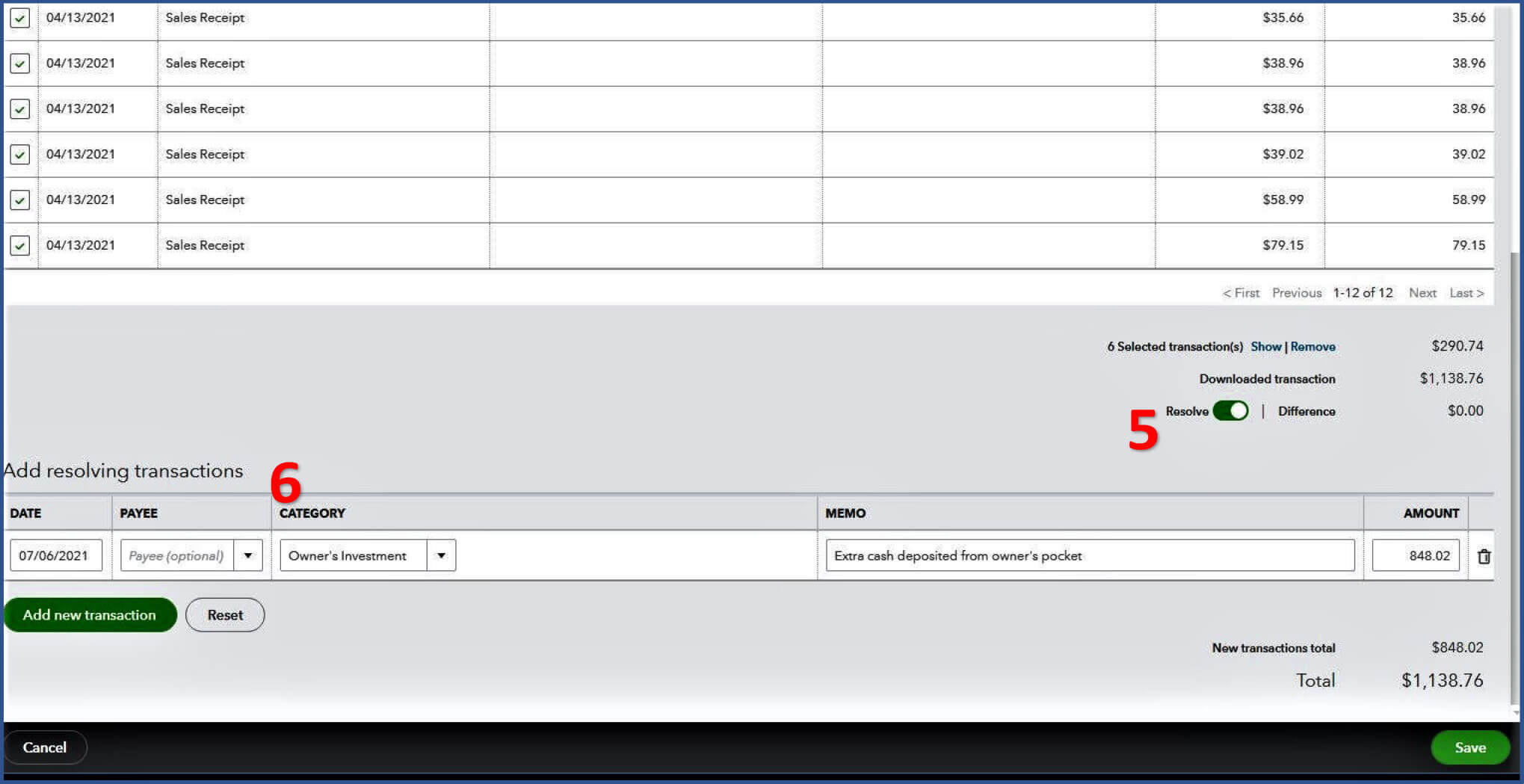

Scenario 1: Deposits tied to multiple sales receipts or invoices. (Matching transactions to Invoices create a receive payment.)

1. These deposits will not show a match. They will usually default to categorize.

2. Expand the transaction and click on “Find Match” in the expanded transactions window.

3. The “Match transactions” window will open.

4. Select all invoices and/or Sales Receipts associated with that deposit.

5. If there are cash/checks deposited not associated with a sales receipt or invoices with this deposit, you can enter it at the bottom by sliding the resolve button to the right.

6. “Add resolving transactions” line appears.

Scenario 2: Transactions that should be matched to a bill. (Matching a transaction to a bill creates a bill payment). Follow the same procedure as you do with the deposit. Bills and expenses will populate instead of Sales Receipts and Invoices.

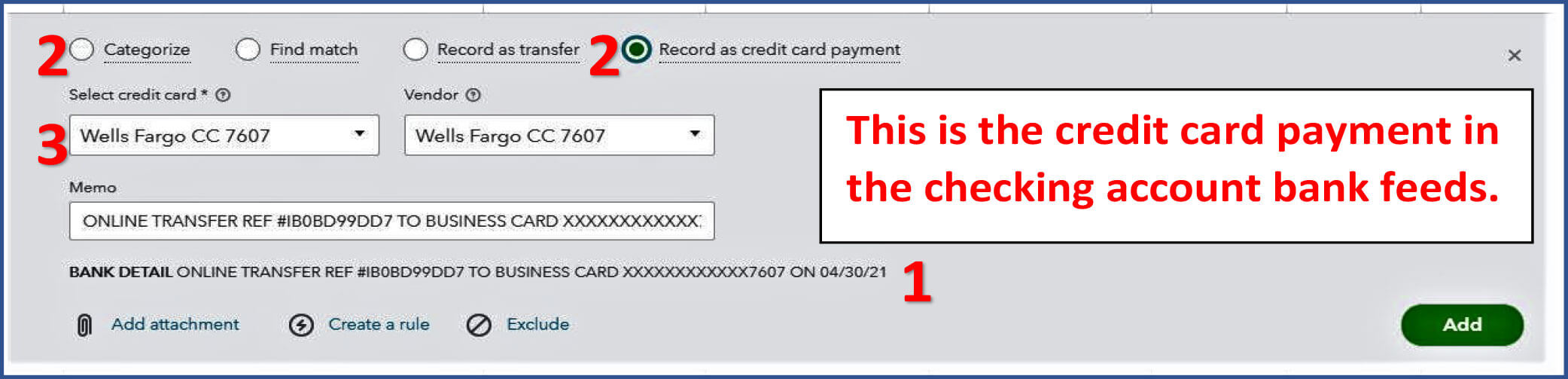

Scenario 3: Credit Card payments added from both the checking account bank feeds and the Credit Card account bank feeds.

The trick to getting this right is to always add the credit card payment in the checking account feeds first and then match that payment in the credit card feeds.

1. Bank detail will show credit card account number. Pay attention.

2. You can use “Categorize” or “Record a credit card payment.

3. Make sure that the correct Credit Card account is selected.

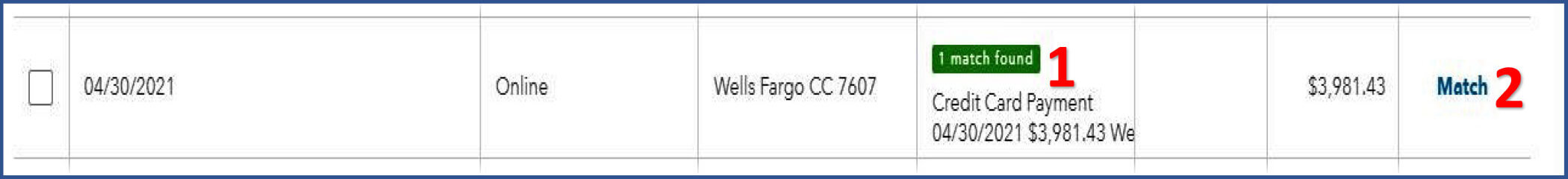

Once the credit card payment from the checking account bank feeds have been added, go to the credit card bank feeds.

1. The payment should show a match.

2. Match it.

3. Done without creating a duplicate.

Bank Feeds Lie:

1. Pay attention to dates, bank details and category.

2. Huge red flag when it defaults to transfer to “Uncategorized Asset/Income.”

3. Avoid using “Record as transfer” unless moving money from one bank to another.

4. Use “Categorize” whenever possible.

Taking a few minutes to pay attention to details when adding transactions from the bank feeds page into your books can save a lot of time and agony later.